So, you're probably wondering why Loft Outlet Online just disappeared. It's a bit of a story, really. It wasn't just one thing, but a mix of problems that hit the retail world hard. Think about how much things have changed with shopping lately. Plus, the company that owned Loft, Ascena Retail Group, had its own big money troubles. All these factors played a part in why you can't shop Loft Outlet online anymore. Let's break it down.

Key Takeaways

- The retail industry was already struggling before the pandemic, with many stores closing. The pandemic just made things worse.

- Ascena Retail Group, the parent company of Loft, was dealing with a lot of debt and had to file for bankruptcy.

- As part of its restructuring, Ascena sold off major brands, including Loft, to another company called Sycamore Partners.

- The closure of Loft Outlet Online is linked to Ascena's financial issues and broader changes in how people shop, especially online.

- Many other well-known retail brands also faced difficulties and bankruptcies around the same time, showing a larger trend in the industry.

The Broader Retail Landscape

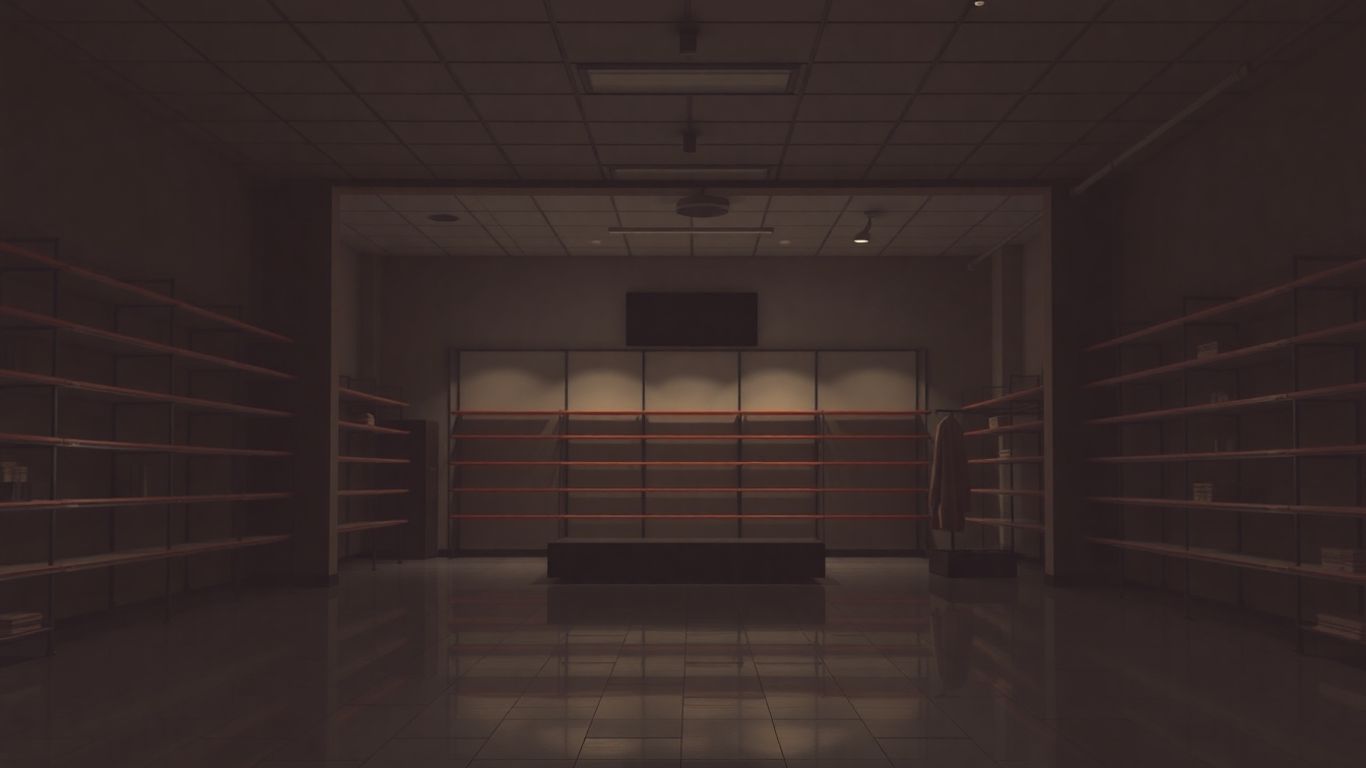

Pre-Pandemic Retail Decline

It's easy to point to the pandemic as the sole reason for the struggles many retailers faced, but the truth is, the cracks were showing long before 2020. We saw a steady stream of store closures even in the years leading up to it. Think about it: over 9,300 U.S. stores shut their doors in 2019 alone, and the year before that, it was close to 6,000. This wasn't a sudden event; it was a slow burn, a gradual shift that had been building for a while.

The Pandemic's Accelerating Impact

While the decline was already happening, the pandemic acted like a supercharger. Suddenly, everyone was staying home. This meant physical stores, which had been the backbone of retail for decades, were forced to close their doors, sometimes for extended periods. This sudden halt put immense pressure on businesses that were already dealing with debt from earlier buyouts and a general shift in how people shopped. It was a perfect storm, and many companies just couldn't weather it.

Shifting Consumer Shopping Habits

People's shopping habits changed dramatically. We were already moving towards online shopping, but the pandemic pushed that trend into overdrive. Suddenly, ordering everything from groceries to clothes online became the norm, not the exception. This meant that retailers who hadn't invested heavily in their online presence or who relied too much on foot traffic from malls found themselves in a really tough spot. The convenience of online shopping, coupled with the necessity of staying home, fundamentally altered the retail landscape.

Here's a look at how some major retailers were impacted:

- Ascena Retail Group: Faced with about $1 billion in debt, this company, which owned brands like Ann Taylor and Loft, filed for Chapter 11 bankruptcy in July 2020. They ended up selling off most of their brands and closing a significant number of their roughly 2,800 stores.

- Brooks Brothers: This historic brand, founded in 1818, also filed for bankruptcy in July 2020. They were already struggling as people dressed more casually for work, and the pandemic accelerated their issues. They closed about 20% of their stores and planned to close factories.

- Belk: This department store chain, a fixture in the Southern U.S., filed for bankruptcy in February 2021. While they emerged quickly with new capital and less debt, their situation was worsened by a leveraged buyout in 2015 that left them with heavy debt, and the pandemic just added to their financial woes.

The shift to online shopping wasn't just a trend; it became a necessity for many consumers during the pandemic. Retailers that couldn't adapt quickly enough to this digital-first world faced significant challenges, often leading to store closures and bankruptcies.

Ascena Retail Group's Financial Struggles

Ascena Retail Group, the parent company for brands like Ann Taylor, Loft, and Lane Bryant, was in a tough spot even before the pandemic hit. They were carrying a pretty big debt load, which made them vulnerable when sales started to dip. It’s like trying to run a marathon with a heavy backpack – eventually, it slows you down.

Significant Debt Burden

Ascena was dealing with roughly $1 billion in debt. This kind of financial pressure can really limit a company's options, especially when unexpected events happen. It means less money for things like updating stores, investing in new technology, or even just weathering a slow sales period. When you owe that much, every dollar counts, and there's not much room for error.

Chapter 11 Bankruptcy Filing

Because of these financial pressures, Ascena filed for Chapter 11 bankruptcy protection in July 2020. This wasn't the end of the company, but rather a way to reorganize its debts and operations. Think of it as hitting the reset button. The goal of Chapter 11 is to allow a company to continue operating while it works out a plan to pay back its creditors.

Impact on Subsidiary Brands

The bankruptcy filing had a big impact on all the brands under the Ascena umbrella. To get back on solid ground, Ascena had to make some tough decisions. This included selling off several of its well-known brands. It was a necessary step to shed debt and streamline the business, but it meant a lot of changes for the brands themselves and their customers. For instance, the sale of key brands like Ann Taylor and Loft to Sycamore Partners was a major part of this restructuring. This move aimed to give these brands a new direction and financial backing, but it also led to a significant reduction in the overall store footprint for Ascena. It’s a bit like when a big company buys out smaller ones; sometimes, not all the original locations stay open. The hope was that this would help the remaining parts of Ascena become more stable. You can see how this kind of financial strain affects everything, even down to specific items like the Urban Elegance Asymmetrical Long Sleeve Blouse, which is no longer available.

The weight of accumulated debt can stifle even established businesses, forcing drastic measures to survive. When a company is saddled with billions in liabilities, its ability to adapt to changing market conditions or unexpected crises is severely compromised, often leading to a painful restructuring process that impacts everything from store operations to product availability.

The Sale of Key Ascena Brands

Acquisition of Ann Taylor and Loft

Ascena Retail Group, the parent company for brands like Ann Taylor, Loft, and Lane Bryant, found itself in a tough spot financially. Facing significant debt, they decided to sell off some of their most recognizable names. In December, Ascena's major brands, including the popular Ann Taylor and Loft, were sold to Sycamore Partners. This move was part of a larger restructuring effort aimed at dealing with the company's financial burdens. It's a pretty common story in retail these days, where companies have to make tough decisions to survive.

Sycamore Partners' Involvement

Sycamore Partners is a private equity firm that has been active in the retail sector. They already owned several other chains, like Belk, which also went through its own restructuring. By acquiring Ann Taylor and Loft, Sycamore aimed to bring stability and a new direction to these established fashion brands. This kind of acquisition often comes with plans to streamline operations and potentially change the store footprint. It's interesting to see how these private equity firms operate, often stepping in when companies are struggling.

Impact on Store Footprint

The sale of these brands naturally led to questions about the future of their physical stores. While the exact number of store closures wasn't immediately detailed for Ann Taylor and Loft specifically, Ascena as a whole had been closing stores even before the sale. For instance, other Ascena brands like Justice and Catherines were sold earlier and subsequently closed all their physical locations, though they continued online. This trend suggests a broader shift away from brick-and-mortar, even for established names. It makes you wonder about the long-term viability of so many physical retail spaces when online shopping is so dominant now. We saw this with brands like DressBarn, which also liquidated its stores and now operates online.

The retail landscape has been changing for years, and the pandemic just sped things up. Companies that couldn't adapt quickly enough, especially those with a lot of debt, really felt the pressure. Sales and acquisitions became a way to survive, but it often meant a smaller physical presence for shoppers.

It's worth noting that Ascena also sold off other brands like DressBarn, which now operates online under new ownership. This pattern of selling off parts of the business or shifting to online-only models highlights the challenges faced by traditional retail. Even a brand like Brooks Brothers, which has been around forever, had to go through a sale process to stay afloat. It really shows how much the industry has changed, and how important it is for brands to keep up with consumer habits, like the move towards online shopping. You can see how this might affect brands like Loft, which had a significant online presence already, but also relied on its physical stores. It's a complex situation for sure, and it makes you think about where fashion retail is headed. For example, the Sky Charm Puff Sleeve Stylish Blouse, a popular item, is currently sold out, showing demand still exists for certain products, but availability can be an issue. This shift impacts how brands connect with customers.

Understanding Why Did Loft Outlet Online Close

So, why did Loft Outlet Online shut its virtual doors? It wasn't just one thing, but a mix of factors that really put the pressure on. Think of it like a perfect storm hitting the retail world.

The Role of Ascena's Restructuring

First off, Loft is part of Ascena Retail Group, and Ascena itself went through some major financial trouble. They had a pretty big debt load, which is never a good look for any company. In July 2020, Ascena filed for Chapter 11 bankruptcy. This is basically a way for companies to reorganize their debts and try to get back on their feet. As part of this process, Ascena had to make some tough decisions about its brands. Many of its stores were closed, and some brands were sold off. Loft and Ann Taylor, for example, were sold to Sycamore Partners. This kind of big shake-up often means that certain parts of the business, like an online-only outlet, might not survive the transition.

Impact of Online-Only Operations

While having an online presence is super important these days, an online-only outlet for a brand like Loft Outlet might have faced its own set of challenges. Sometimes, these outlets are designed to move excess inventory from the main stores. If the main stores are also struggling or changing their own inventory strategies, it can affect the outlet's purpose. Plus, the online retail space is incredibly crowded. Standing out and driving enough traffic to make an online-only outlet profitable, especially when it's not directly tied to a physical store experience, can be a real uphill battle. It's tough to get people to notice you when there are so many other options out there, like the Cozy Ease Dropped Shoulder Knit Sweater which is currently sold out.

Broader Industry Trends Affecting Closures

It's also important to remember that Loft Outlet Online didn't close in a vacuum. The whole retail industry has been changing for years. Even before the pandemic, people were shifting how they shopped, moving more towards online purchases. The pandemic just sped all of that up. Brands that couldn't adapt quickly enough, or that were already carrying a lot of debt, found themselves in a really difficult spot. We saw other big names like Belk and Brooks Brothers also facing serious financial challenges and needing to restructure. It’s a tough market out there, and companies have to be really smart and flexible to keep up.

The retail environment is constantly evolving, and companies that don't adapt to changing consumer behaviors and economic pressures often find themselves on shaky ground. This was certainly the case for many brands during the period leading up to and following the pandemic.

Examining Other Retail Bankruptcies

It's not just Loft or its parent company, Ascena, that have been struggling. The retail world has seen a lot of big names go through tough times, especially with the shifts brought on by the pandemic. Looking at other companies can give us a clearer picture of what's happening in the industry.

Belk's Debt and Restructuring

Belk, a department store chain with a long history, filed for Chapter 11 bankruptcy in early 2021. They managed to get out of it pretty quickly, actually, just a day later. The plan involved getting new capital and cutting down on their debt.

- Debt Reduction: Belk eliminated $450 million in debt.

- New Capital: They secured $225 million in new funding.

- Store Footprint: Importantly, all 291 of their stores stayed open, and no jobs were lost during this process.

Belk's situation was heavily influenced by a leveraged buyout in 2015, which left them with a lot of debt. The pandemic just made things worse, pushing them to restructure.

Brooks Brothers' Challenges

Brooks Brothers, a brand that's been around since 1818 and practically defined American business attire for ages, also filed for bankruptcy in July 2020. The shift towards more casual dressing, and then the pandemic keeping people out of offices, really hit them hard.

- Store Closures: They decided not to reopen about 20% of their stores even before the bankruptcy filing.

- Factory Impact: The company also planned to close its three U.S. factories.

- Acquisition: A joint venture bought Brooks Brothers, agreeing to keep at least 125 stores open.

The brand faced a tough market as work-from-home became the norm, changing how people dressed for their daily lives.

Century 21 Stores' Fate

Century 21 Stores, a well-known off-price department store, also faced significant challenges. While the provided text doesn't detail their bankruptcy filing, it's part of a larger trend of retailers struggling to adapt. Many of these stores, like Century 21, relied heavily on in-person shopping and a specific customer base that was disrupted by changing consumer habits and economic pressures. Their story, like others, highlights the intense pressure on brick-and-mortar retail.

These examples show that financial struggles, debt, and changing consumer behavior are widespread issues. It's a tough environment out there for many fashion retailers, and it makes sense why brands like Loft Outlet Online would also face closure. You can find some great dresses that are perfect for many occasions, even as the retail landscape shifts. Shop now for a timeless addition to your wardrobe.

The Future of Fashion Retail

So, what's next for fashion after all these closures and shifts? It's pretty clear that the way people shop for clothes has changed, and brands really need to keep up. The whole online shopping thing isn't just a trend anymore; it's how a lot of us do things now. Think about it, you can find almost anything you want with just a few clicks, like that Luxe Flicker Trendy Mini Dress that sold out so fast. This means brands have to make their websites and online experiences top-notch.

Adaptation to E-commerce

Getting the online part right is super important. It's not just about having a website; it's about making it easy and enjoyable to shop. This includes:

- User-friendly websites: Easy navigation, clear product photos, and simple checkout processes.

- Mobile optimization: Most people shop on their phones, so the site needs to work perfectly on smaller screens.

- Fast and affordable shipping: Nobody likes waiting ages for their order or paying a ton for delivery.

- Hassle-free returns: Making it simple to send things back if they don't fit or aren't quite right builds trust.

The Importance of Brand Strategy

Beyond just selling online, brands need a clear idea of who they are and what they stand for. What makes them different from everyone else? It's not enough to just sell clothes; people want to connect with a brand's story or values. This could mean focusing on sustainability, unique designs, or a specific community. Having a strong identity helps customers choose one brand over another, especially when there are so many options out there.

The retail world is always changing, and brands that don't adapt get left behind. It's about being flexible and listening to what customers want, even when those wants change quickly.

Navigating Economic Uncertainty

Of course, the economy plays a big role too. When people are worried about money, they tend to spend less on things like new clothes. Brands need to be smart about how they manage their money and plan for different economic situations. This might mean offering a range of price points or being really efficient with their operations. It's a balancing act, for sure, trying to stay relevant and profitable when so much is out of a company's control.

The world of fashion is changing fast! Online stores are becoming super popular, and how we shop is changing too. Think about cool new ways to find clothes and get them right to your door. It's all about making shopping easy and fun.

So, What's the Takeaway?

It's clear that the closure of Loft Outlet Online wasn't just a random event. Like many other retailers, it was caught in a tough spot. The shift to online shopping, combined with the economic pressures that really ramped up during the pandemic, made things difficult. Ascena Retail, the parent company, had to make some big changes, selling off brands like Loft. While it's a bummer for shoppers who liked the convenience of the online outlet, it's part of a bigger story about how retail is changing. We've seen this pattern before with other big names struggling, and it looks like Loft Outlet Online is another chapter in that ongoing shift.

Frequently Asked Questions

Was Loft Outlet Online really closed, or did it just move?

The Loft Outlet online store did close. It wasn't a move to a new web address. This happened as part of bigger changes within the company that owns Loft.

Why did so many stores close around the same time?

Many stores faced tough times even before the pandemic. Things like lots of debt and people shopping online more made it hard for them. The pandemic made these problems much worse, leading to many store closures.

What is Ascena Retail Group?

Ascena Retail Group was a big company that owned many popular clothing stores, including Loft, Ann Taylor, and Lane Bryant. They had a lot of debt and had to go through a process called bankruptcy to try and fix their money problems.

Did the closing of the online outlet affect the regular Loft stores?

Yes, the changes that led to the online outlet closing also impacted the physical Loft stores. Many stores were closed as part of the company's plan to deal with its financial issues.

Who bought Loft and Ann Taylor?

A company called Sycamore Partners bought Loft and Ann Taylor. Sycamore Partners is a firm that buys and manages different brands. This sale was part of Ascena's plan to get out of debt.

What does it mean when a company files for bankruptcy?

When a company files for bankruptcy, it's usually because it owes a lot of money and can't pay its bills. It's a legal way to try and reorganize the business, sell off parts, or reduce debt so it can survive.